Instant Reaction: CPI, June 12, 2024

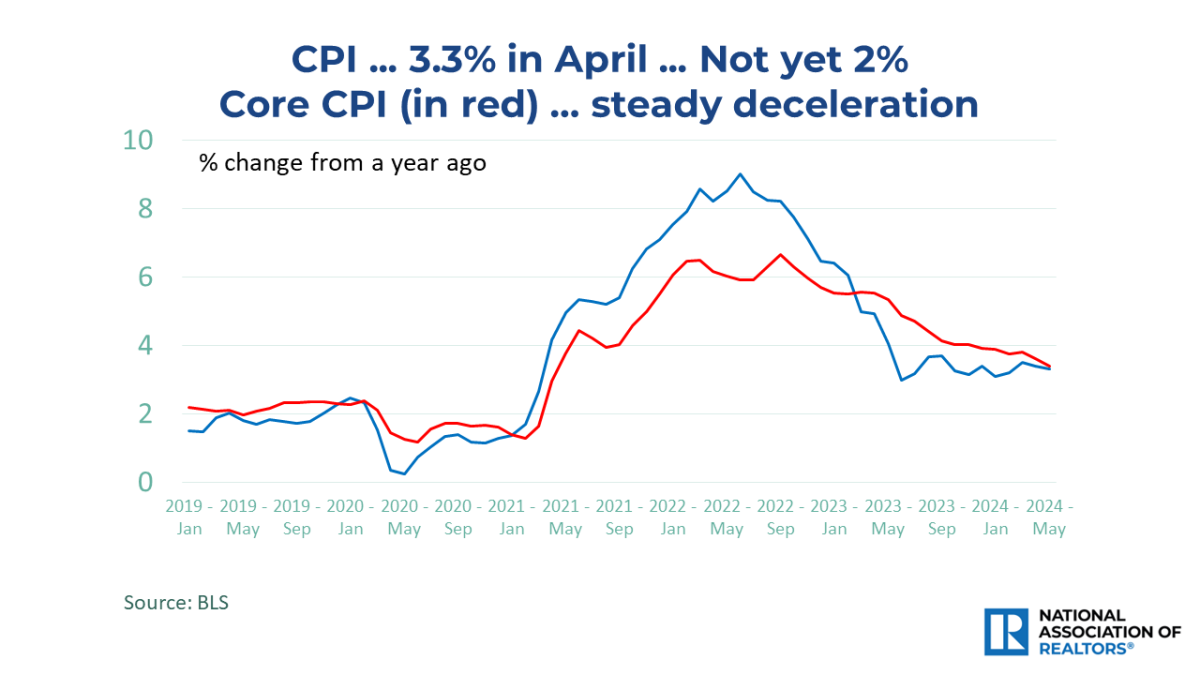

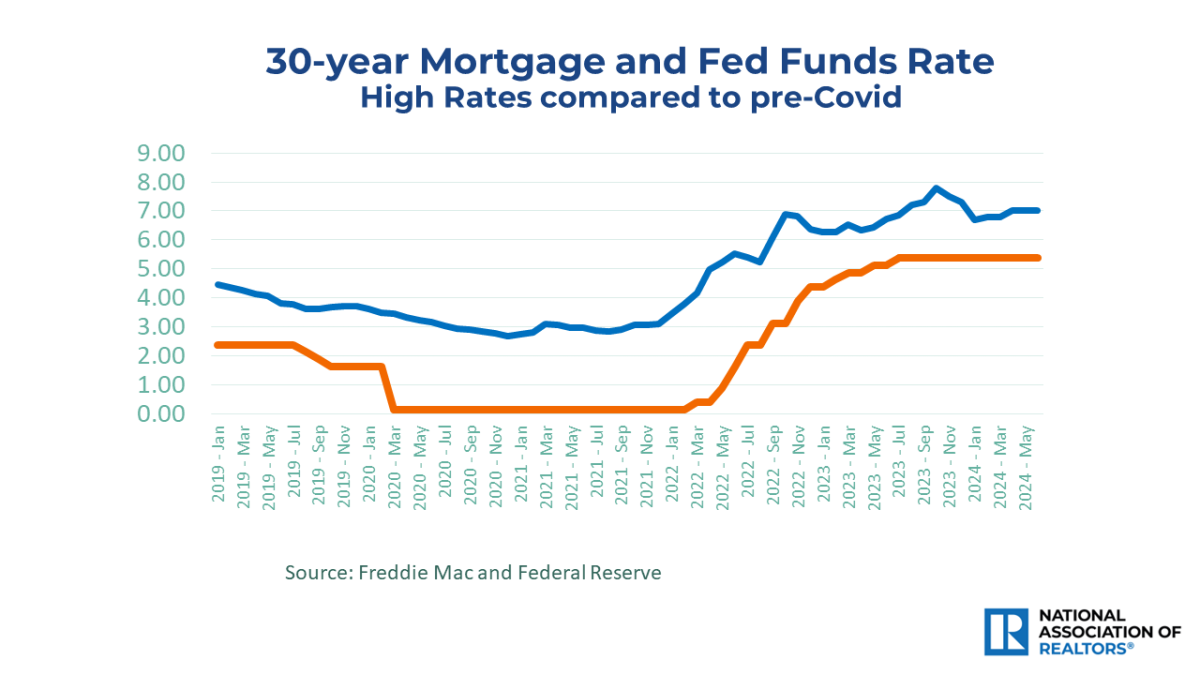

Inflation is moving in the right direction, but it is not quite at the point for the Fed to cut interest rates. The all-important consumer price inflation rose by 3.3% from a year ago. “Core” inflation decelerated to 3.4%, its slowest gain in three years. The target is 2% inflation. The recent peak inflation rate of 9% two years ago was a shocker, precipitating the aggressive interest hike policy by the Fed. The central bank can reverse that policy as better inflation figures continue in the upcoming months.

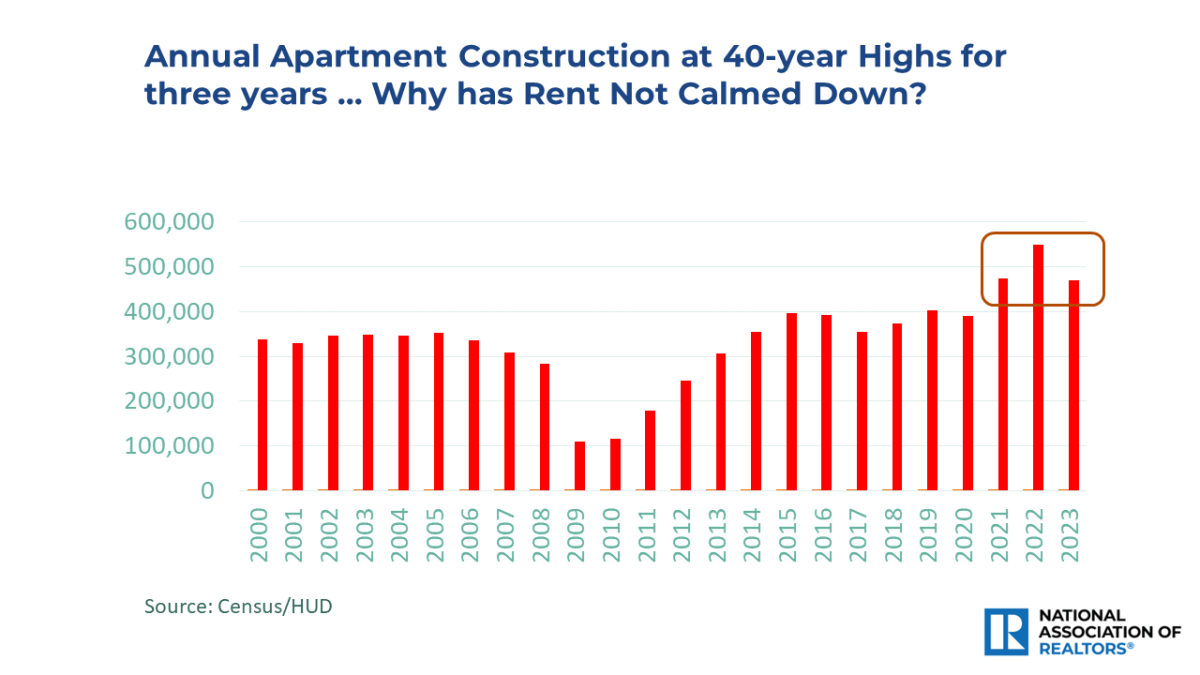

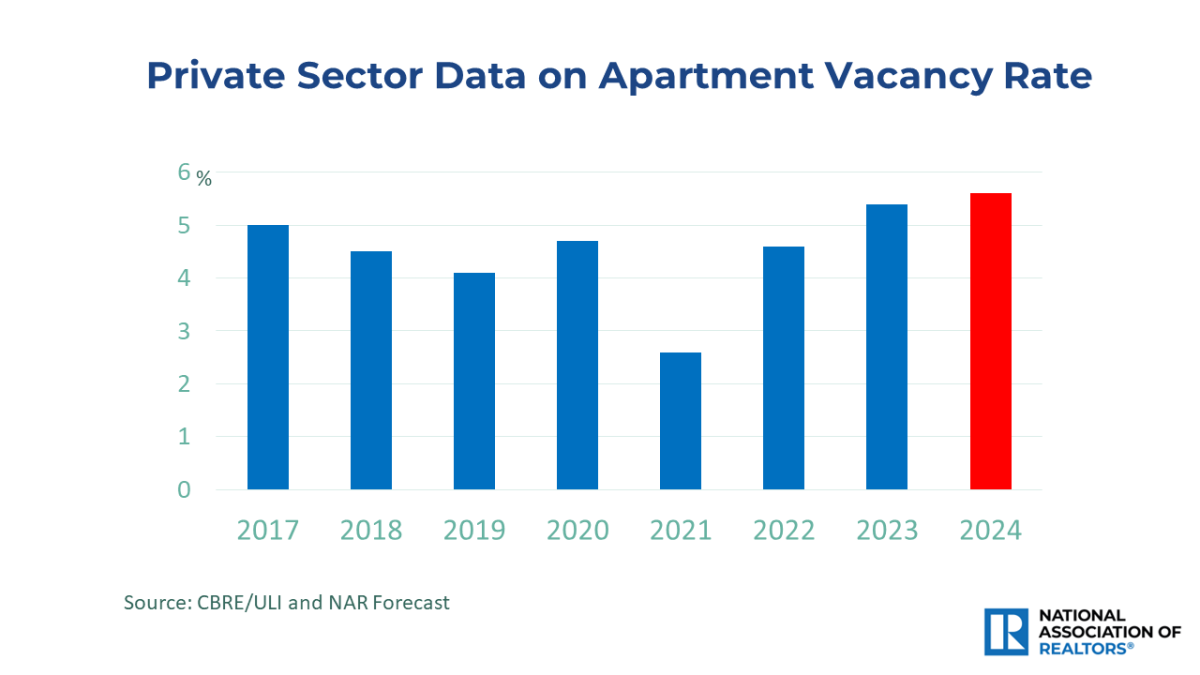

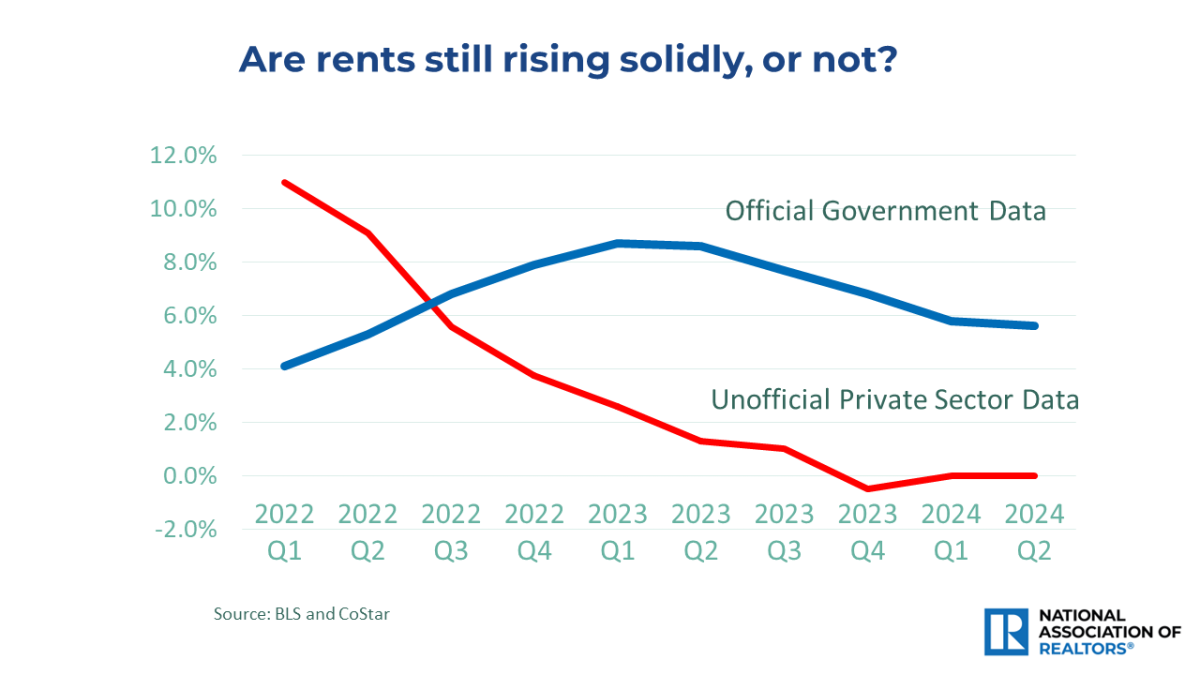

The shelter component is the heavyweight driver, and it was up 5.4%; still high but the slowest gain in two years. The non-official private sector data points to rising apartment vacancy rates from temporary oversupply, and rents are essentially showing no increases. So, official consumer price inflation, with a lag time, no doubt has more room to slow down.

The timing of the first rate cut is uncertain. But the longer-term outlook is for the Fed to cut interest rates 6 to 8 rounds by the end of next year. Home prices will remain solid, and home sales will pick up, especially in regions with rising inventory.

Categories

Recent Posts

LISTINGS

- 3 Beds2 Baths1,800 SqFt3DPending

$485,000

- 4 Beds3 Baths2,784 SqFtOff Market

$899,000

- 2 Beds1.75 Baths1,077 SqFt1/24 24Open Sat 1PM-3PM

$348,000

LET'S CHAT ABOUT YOUR HOME GOALS

Managing Broker | License ID: 28006